Check your free credit report.

An important part of financial health is keeping track of your credit history. It’s becoming easier than ever to get your credit score – often even your credit card will track it for you. But did you know your credit report is more than just your score? It also contains your credit history, and it’s important to make sure it’s accurate and current as it determines your ability to get loans now and in the future. You can get your credit report for free!

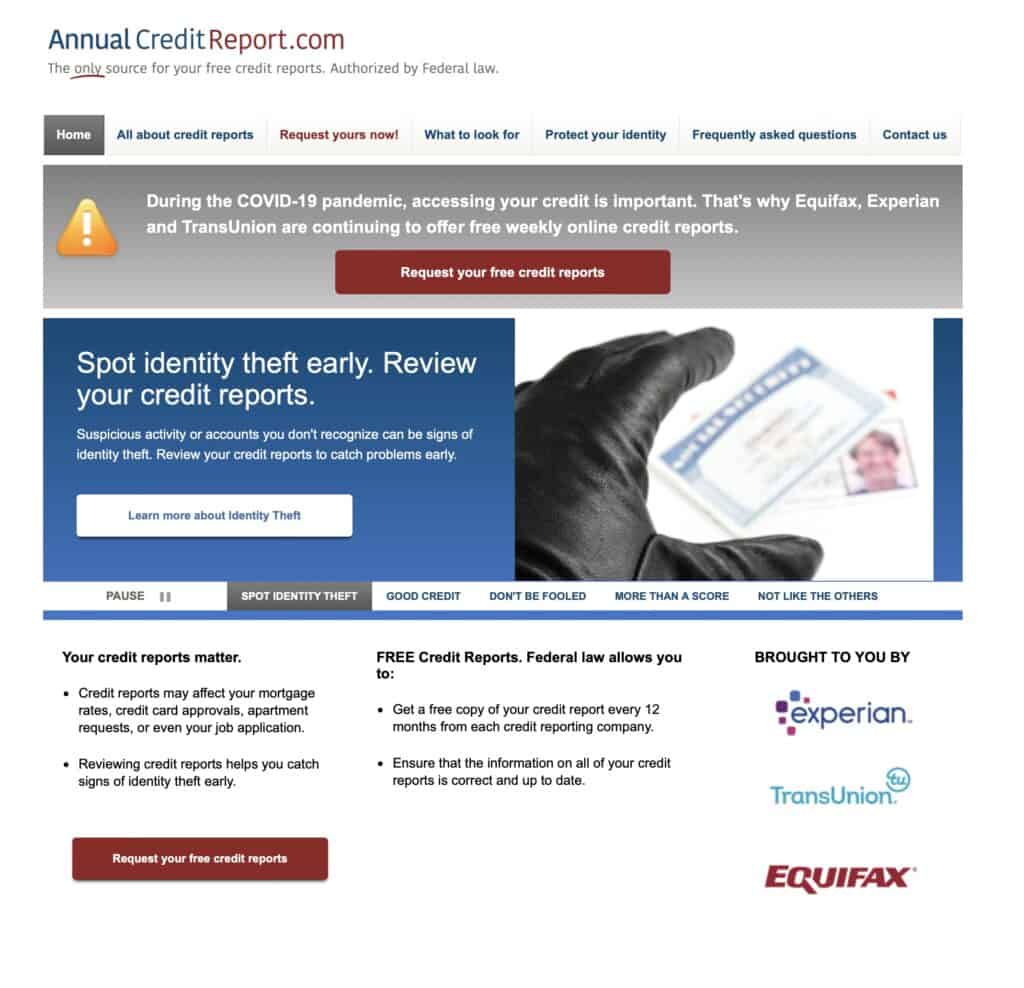

Please be aware, there is only one safe place to check your credit report, authorized by the federal government. Do not use other websites claiming to offer credit reports, they can steal your information and your identity. We will only ever recommend that you use federally authorized AnnualCreditReport.com because we’re confident your information will stay safe.

What else should I know about credit reporting?

When you visit www.annualcreditreport.com you can get a report from TransUnion, Equifax or Experian. You’ll get your report which includes your personal information, your score and gives your credit history. It’s important to check the information to make sure your information is correct. If someone has used your name or credit card you’ll see it on your report. Checking it often can help you catch identity theft, fraud or even just mistakes.

Typically you can check your report with each of the three companies for free once a year. That means you can check your credit three times a year, by choosing a different reporting company each time. We recommend you check your report roughly every six months to ensure all your information and credit history are correct. Currently, during the COVID-19 pandemic, all three companies are offering weekly online reports so you can stay more informed than ever.

Problems on your report? We can help.

You’ve checked your report and found some errors? Checking your credit regularly can help you find those errors before you’re in the uncomfortable position of finding out about the problems when you’re being denied for a loan. If there’s a mistake, you have rights and protection under the Fair Credit Reporting Act, and you can send a letter to one of the credit reporting agencies asking them to fix your report.

However, in cases of identity theft or sometimes even incorrect reporting, it’s not always as simple as a letter. If you start having trouble getting your credit report fixed, please call us. We can often help you litigate your case on a contingency basis. That means we don’t get paid unless we help you recover your credit and good name. And we’re always happy to offer a free first consultation where you’ll know whether or not we can help.

Get help today.

Request a free consultation

We know that facing financial difficulties is hard, and you don’t have to do it alone. Schedule a consultation with us and we’ll help you create a brighter future.